Know Your Investor Service

Know Your Investor – The use of sophisticated methods by criminals to accomplish their evil objectives is becoming more common in today’s advanced world. They exploit financial institutions and digital businesses to access accounts, benefit from free services, and convert their illegal revenues into legal currency. Before establishing connections with individual and corporate investors, it’s essential to know who to connect with in both the financial and other sectors. It is crucial to carry out online investor verification to confirm investors using their personal information, sources of funding, and corporate profiles.

Despite tight regulations and regulatory limitations, investment fraud has grown to be the most widespread scam worldwide. A lot of people are talking about investment scams lately because both individuals and businesses need to be conscious of the dangers involved. On the other side, investors are pouring money into digital projects and rushing to digital sites. Thus, know your investor service is becoming essential to combat fraud.

Types of Investors

Before investor onboarding, it is essential to know different types of investors that are as under:

1. Accredited Investor

An investor is permitted to make investments, according to the SEC, even without a license or other approval from the agency. Authorized investors have access to stock, alternative investments, and crowdfunding, while non-accredited investors do not. Due to their potential to help them engage in unregistered schemes, these investors are attracted to the majority of firms. Or, to put it differently, accredited investors’ main objective is to assist companies in raising capital through the purchase of securities. The SEC’s company registration requirements can be avoided, nevertheless, to potentially make a large profit while also saving a significant amount of cash on filing costs.

2. Qualified Investor

Success for a qualified investor depends on their working environment and the status of the commercial contracts. In other words, a person who qualifies as a legal entity and is allowed to invest in capital funds, private assets, and placements through constrained offers. Investment firms, banking institutions, credit card corporations, and a number of other government entities are examples of qualified investors.

3. Sophisticated investors

Another group that is considered to have extensive knowledge and business acumen, making them suited for particular reforms and perks, is sophisticated investors. But, this can also be used to describe an investor with such a particular level of market influence. Several legal definitions determine how an entity is categorized as sophisticated or permitted. Due to their substantial net capital and reliable source of income, this type of investor is qualified to take advantage of opportunities that are not accessible to ordinary investors. Furthermore, knowledgeable investors run the danger of suffering substantial financial losses because they are not required to liquidate the assets. All this requires firms to establish investor authentication systems.

Investment Fraud Cases

Shufti Pro News makes it clear that investment fraud becomes more prevalent as the sector develops quickly. Scams like this one happen when fraudsters employ deception to induce honest investors to purchase assets based on incorrect information. In order to attract investment, reputable businesses also mislead customers about their auditing, large earnings, and a range of other deceptive statements.

- One Coin Fraud: The founder of this scam used a pyramid scheme to carry it out by selling the currency to multi-level advertising companies, who then tricked customers into buying it.

- Boiler Room Scam: The second-largest criminal case is this technique. The victims were chosen by cold calling, and they were subsequently convinced to invest in alluring stock in a Madeira-based firm.

A sophisticated investor verification service can be used to combat all of the above frauds. Recently, several businesses began to accept foreign investments such as the Shufti Pro Funding for this reason.

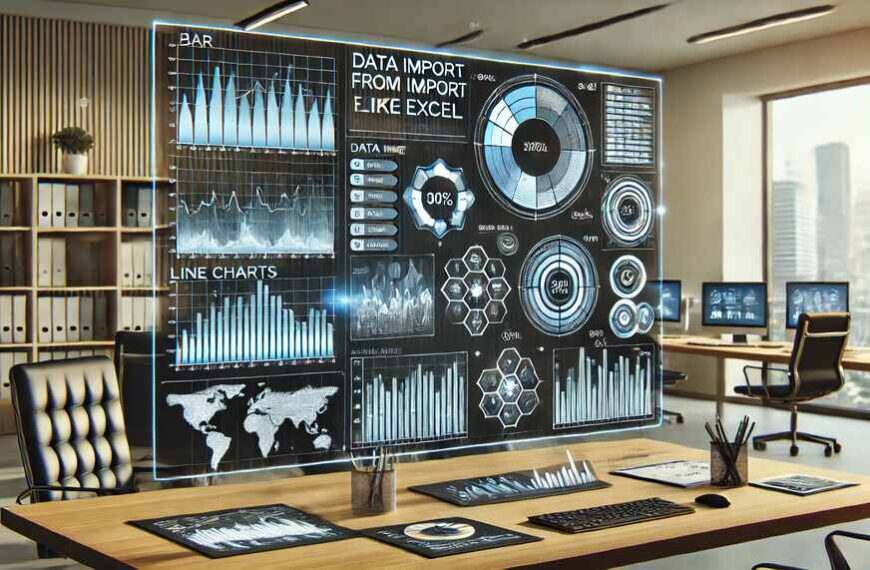

Process of Know Your Investor Verification Solution

Know your investor system is a good option for investment and financial companies looking to adhere to regulations and protect their companies. The digital investor verification solution can quickly and accurately confirm the true names of investors reliably.

The following steps are part of the online investor verification service:

- The investor provides company documents as well as proof of identity.

- The investor’s documents are examined by qualified MLROs.

- Through an anti-money laundering mechanism, investors are checked against international watchlists.

- The verified results by know your investor solution are stored in the back end.

Final Thoughts

Despite several international laws and the investing company’s efforts, criminal activity is regularly on the rise. Financial firms and other investment businesses can determine if the investors are real, competent, reliable, and risk-free by analyzing their market position. By incorporating the know your investor service into the current identity authentication method, businesses may efficiently stop money laundering activities, enroll legitimate companies, and improve their operations.